Crypto Payments and Taxes: A Complete Guide to Regulations and Compliance for Businesses in 2025

The digital frontier of commerce is rapidly expanding, and at its heart lies the revolutionary power of cryptocurrency. For businesses in 2025, accepting digital assets is no longer a niche experiment but a strategic move towards capturing a global, tech-savvy customer base. However, this innovation brings with it a complex and evolving challenge: navigating the intricate world of crypto payments and taxes.

As governments and regulatory bodies worldwide scramble to keep pace with financial technology, the rules governing digital asset transactions have become a critical area of focus. For any business integrating crypto, understanding these regulations isn’t just good practice—it’s essential for survival and long-term success. Missteps can lead to severe penalties, audits, and a tarnished reputation.

This comprehensive guide is designed to demystify the complexities surrounding crypto payments and taxes. We will delve into the fundamental principles, explore the global regulatory landscape, provide a practical compliance checklist, and look ahead to what the future holds. Properly managing crypto payments and taxes is the cornerstone of leveraging this technology responsibly and profitably.

Understanding the Fundamentals of Crypto Payments and Taxes

Before a business can build a robust compliance strategy, it must grasp the core concepts that underpin the entire framework of crypto payments and taxes. Unlike traditional fiat currency, which has a straightforward tax treatment, cryptocurrencies are viewed differently by most tax authorities, creating unique obligations for businesses.

What Constitutes a Taxable Crypto Event for Businesses?

For tax purposes, nearly every transaction involving cryptocurrency can be a “taxable event.” This is a crucial concept to understand because it triggers a reporting requirement and a potential tax liability. A common misunderstanding is that taxes are only due when crypto is sold for fiat currency like the US dollar. This is incorrect.

Key taxable events for businesses include:

- Receiving Crypto for Goods or Services: When a customer pays for a product with Bitcoin, Ethereum, or any other cryptocurrency, your business has received income. The value of this income is the Fair Market Value (FMV) of the crypto in your local currency at the exact time of the transaction.

- Converting One Cryptocurrency to Another: If your business receives payment in Bitcoin and immediately trades it for a stablecoin like USDC, this is a disposition of the Bitcoin. You may realize a capital gain or loss on the Bitcoin in the seconds or minutes you held it.

- Paying for Business Expenses with Crypto: Using crypto to pay suppliers, for software subscriptions, or any other operational cost is treated as selling the crypto for its FMV and then using the cash proceeds for the payment. This is a taxable event.

- Paying Employees or Contractors in Crypto: This falls under crypto payroll and has specific implications for both income and payroll taxes, making the landscape of crypto payments and taxes even more intricate.

Differentiating Between Cryptocurrencies: Property vs. Currency

The single most important distinction made by agencies like the Internal Revenue Service (IRS) in the United States is that cryptocurrency is treated as property, not currency, for tax purposes. This classification is the root of most of the complexity surrounding crypto payments and taxes.

When you deal with property, the rules of capital gains and losses apply. If your business receives 1 ETH as payment when it’s worth $3,000 and later uses that same 1 ETH to pay a supplier when it’s worth $3,200, your business has realized a $200 capital gain. This gain is separate from the initial income of $3,000 you recorded. This dual-nature tracking is a significant challenge in managing crypto payments and taxes.

The Role of Fair Market Value (FMV) in Crypto Taxation

Since crypto is treated as property, every transaction must be valued in your local fiat currency. This is known as the Fair Market Value (FMV). Determining the FMV is a critical step in maintaining compliant records for crypto payments and taxes.

The FMV is the price a willing buyer would pay a willing seller on the open market. For cryptocurrencies, this is typically determined by referencing a reputable cryptocurrency exchange at the precise date and time of the transaction. Consistency is key. Your business should choose a reliable pricing source and use it for all transactions to ensure accurate reporting. Failing to properly document the FMV at the moment of each transaction can create massive headaches during tax season.

Navigating the Global Regulatory Landscape in 2025

The approach to crypto payments and taxes varies significantly from one country to another. For businesses operating globally, this patchwork of regulations requires careful attention. As we move through 2025, several key jurisdictions have established clearer, more robust frameworks that serve as a bellwether for global trends.

The United States: The IRS Perspective on Crypto Payments and Taxes

The United States has been one of the most proactive nations in issuing guidance on crypto payments and taxes. The IRS continues to refine its stance, and compliance is a major enforcement priority.

- Reporting Income: Businesses must report crypto payments received as gross income, valued at the FMV on the date of receipt.

- Tracking Capital Gains/Losses: Every disposition of crypto must be tracked. Businesses must calculate the difference between the FMV when received (cost basis) and the FMV when spent or sold (proceeds). This is reported on Form 8949 and summarized on Schedule D.

- New Broker Reporting Rules: Starting with the 2025 tax year, new regulations will require crypto “brokers” to issue Form 1099-DA to customers and the IRS. The definition of a broker is broad and could potentially impact various entities in the crypto space, further shaping the future of crypto payments and taxes.

The European Union: MiCA and its Implications

The European Union has taken a major step towards harmonized regulation with the Markets in Crypto-Assets (MiCA) framework. While MiCA focuses more on consumer protection, issuer requirements, and market stability, it has a significant indirect impact on crypto payments and taxes by creating a more structured environment.

Taxation itself is still determined by individual member states, but the clarity from MiCA makes it easier for businesses to operate across borders. Most EU countries also treat crypto as property, with capital gains tax applicable upon disposition. However, Value Added Tax (VAT) rules can be complex. The Court of Justice of the European Union has ruled that exchanging crypto for fiat is exempt from VAT, but the application of VAT on goods and services paid for with crypto generally follows standard rules. This is a key consideration for EU businesses dealing with crypto payments and taxes.

Key Regulations in the United Kingdom (HMRC)

His Majesty’s Revenue and Customs (HMRC) in the UK has provided detailed guidance that aligns closely with the US approach. Cryptoassets are treated as property, and businesses are subject to multiple forms of taxation.

- Corporation Tax: Gains from selling crypto are subject to Corporation Tax.

- Income Tax: The value of crypto received for goods or services is considered revenue for income calculation purposes.

- VAT: HMRC’s guidance states that while the exchange of crypto for fiat is generally outside the scope of VAT, charges for transaction verification (mining) may be. This nuance highlights the detailed nature of UK rules on crypto payments and taxes.

A Detailed Comparison of Tax Treatments

To better illustrate the differences, the table below compares key aspects of crypto payments and taxes across major jurisdictions.

| Feature | United States (IRS) | European Union (Varies by State) | United Kingdom (HMRC) |

| Asset Classification | Property | Generally Property/Private Asset | Property (Cryptoasset) |

| Receiving Crypto Payment | Taxable as ordinary income based on FMV at time of receipt. | Taxable as revenue/income based on FMV at time of receipt. | Taxable as revenue based on FMV at time of receipt. |

| Spending/Selling Crypto | Triggers a capital gains/loss event. | Triggers a capital gains/loss event. | Triggers a chargeable gains event for Corporation Tax. |

| Paying Employees | Considered wages. Subject to income and payroll tax withholding. | Considered a Benefit-in-Kind. Subject to payroll taxes. | Treated as income. Subject to PAYE and National Insurance. |

| VAT/Sales Tax | Sales tax applies to the underlying goods/services, not the crypto. | VAT applies to the underlying goods/services. Crypto-fiat exchange is exempt. | VAT applies to the underlying goods/services. |

| Key Reporting Form | Form 8949 (Sales and Other Dispositions of Capital Assets) | Varies by member state. | Corporation Tax Return (CT600) |

A Practical Compliance Checklist for Businesses Accepting Crypto

Moving from theory to practice is essential for any business looking to manage its obligations regarding crypto payments and taxes effectively. A systematic approach is the only way to ensure accuracy and avoid compliance pitfalls.

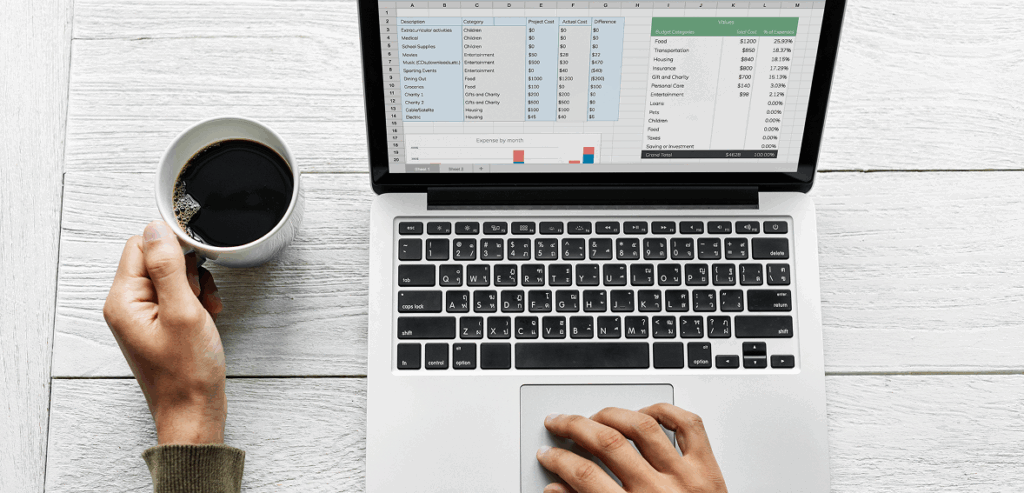

Setting Up Your Accounting System for Crypto

Your traditional accounting software is likely not equipped to handle the complexities of crypto. Integrating specialized tools is a non-negotiable first step.

- Dedicated Crypto Wallets: Use separate, dedicated wallets for business transactions to avoid commingling business and personal funds. This simplifies tracking.

- Crypto Tax Software Integration: Choose a reputable crypto tax and accounting platform (e.g., CoinLedger, Koinly, TaxBit). These tools can connect to your wallets and exchanges via API to automatically track transactions.

- Chart of Accounts: Work with your accountant to add new accounts to your chart of accounts, such as “Digital Asset Holdings” and “Realized Crypto Gains/Losses.” This is a fundamental step in organizing your crypto payments and taxes.

Accurate Record-Keeping: The Bedrock of Compliance

Tax authorities demand meticulous records. For every single crypto transaction, your business must be able to produce the following information:

- The date and time of the transaction.

- The type and amount of cryptocurrency involved.

- The Fair Market Value (FMV) in your local currency at the time of the transaction.

- The cost basis of the crypto (what its FMV was when you acquired it).

- The purpose of the transaction (e.g., sale of goods, payment to supplier).

- Any transaction fees paid, as these can often be deducted or added to the basis.

Maintaining this level of detail manually is nearly impossible for a business with any significant transaction volume. This reinforces the need for specialized software that can handle the complexities of crypto payments and taxes.

Calculating Capital Gains and Losses

The core calculation for crypto payments and taxes involves determining the gain or loss on each disposition. The formula is simple in theory but complex in practice:

Capital Gain/Loss = Fair Market Value at Disposition – Cost Basis

- Cost Basis: This is the FMV of the asset when you acquired it, plus any associated fees.

- Disposition: This occurs when you sell, trade, or spend the crypto.

For example, if a customer pays you 0.05 BTC, valued at $3,000 at the time. This $3,000 is your income. Your cost basis in that 0.05 BTC is $3,000. If you later use that same 0.05 BTC to pay a vendor when its value has risen to $3,300, you have a capital gain of

300(300(3,300 – $3,000). Your business will owe tax on both the initial $3,000 of income and the subsequent $300 capital gain.

Reporting Requirements: Forms and Deadlines

Knowing which forms to file and when is crucial. In the U.S., businesses will primarily deal with:

- Form 1120 (U.S. Corporation Income Tax Return): Where you report your overall business income, including revenue from crypto payments.

- Form 8949: To detail every single crypto disposition, listing the dates acquired and sold, proceeds, cost basis, and gain or loss.

- Schedule D: To summarize the short-term and long-term capital gains and losses from Form 8949.

Staying organized throughout the year is the only way to make filing for crypto payments and taxes a manageable process. Waiting until the last minute is a recipe for errors and overpayment.

Choosing the Right Crypto Tax Software

The market for software designed to handle crypto payments and taxes has matured significantly. When evaluating options, consider the following:

- Integrations: Does it connect seamlessly with the exchanges and wallets your business uses?

- Accuracy: Does it have a reliable method for determining historical FMV?

- Reporting Features: Can it generate the specific forms required by your tax authority, like Form 8949?

- Inventory Method: Does it support different accounting methods like First-In, First-Out (FIFO) or Specific Identification?

Advanced Topics in Crypto Payments and Taxes for 2025

As the crypto ecosystem evolves, so do the tax challenges. Businesses pushing the boundaries of digital commerce need to be aware of several advanced topics that complicate the already dense subject of crypto payments and taxes.

Paying Employees and Contractors in Crypto

Paying salaries in crypto is an attractive option for Web3 native companies, but it creates significant tax and administrative burdens.

- For Employees: Crypto wages are subject to federal income tax withholding, Social Security, and Medicare taxes (FICA), just like cash wages. The employer must determine the FMV of the crypto at the time of payment to calculate the correct withholding amounts, which must be remitted to the IRS in fiat.

- For Contractors: Payments to contractors in crypto valued at $600 or more in a year require the business to issue a Form 1099-NEC, reporting the FMV of the crypto paid as nonemployee compensation.

Properly managing payroll is a highly technical aspect of crypto payments and taxes that often requires expert guidance.

DeFi, Staking, and NFTs: The New Tax Frontiers

The tax treatment of activities beyond simple payments is still an area with evolving guidance.

- DeFi (Decentralized Finance): Activities like liquidity mining and yield farming can generate income that is often taxed as ordinary income upon receipt. The complexity of tracking these rewards across different protocols is immense.

- Staking Rewards: The IRS has indicated that staking rewards are treated as income at their FMV when the taxpayer gains “dominion and control” over them. This is a critical area of focus within crypto payments and taxes.

- NFTs (Non-Fungible Tokens): For a business, creating and selling an NFT results in ordinary income. For a business that buys and later sells an NFT, it is typically treated as a capital asset, similar to other cryptocurrencies.

Handling Sales Tax and VAT on Crypto Transactions

A frequently overlooked issue is sales tax or VAT. The taxability of a sale is determined by the product or service being sold, not the method of payment. If you sell a taxable product, you must collect sales tax. The challenge with crypto payments is calculating the correct amount. You must base the sales tax on the FMV of the crypto at the moment of the sale and remit that tax to the state or country in fiat currency. This adds another layer of real-time calculation to the process of handling crypto payments and taxes.

The Importance of Professional Consultation

The information in this guide provides a strong foundation, but it is not a substitute for professional legal or tax advice. The field of crypto payments and taxes is highly specialized and changes rapidly. Partnering with a Certified Public Accountant (CPA) or tax attorney who has demonstrable expertise in digital assets is the most important investment a business can make in this area. They can provide tailored advice, help navigate audits, and ensure your compliance strategy is future-proof.

Future Outlook: What to Expect Beyond 2025

The world of crypto payments and taxes is anything but static. As we look towards the latter half of the decade, several trends are likely to shape the compliance landscape for businesses.

The Trend Towards Regulatory Clarity

The era of regulatory ambiguity is slowly coming to an end. Major economies are moving towards comprehensive frameworks like MiCA. This trend is a positive development for businesses, as clarity, even if strict, is preferable to uncertainty. Clearer rules of the road will reduce compliance risk and foster broader adoption of crypto payments. The continuing evolution of regulations is a constant in the world of crypto payments and taxes.

Potential Changes in Tax Law

Tax laws will continue to adapt to the unique nature of the underlying blockchain technology. We may see the introduction of de minimis exemptions for small transactions, which would simplify the tax treatment of minor crypto purchases. We could also see more specific guidance on DeFi, staking, and other complex activities, providing businesses with a clearer path to compliance for all forms of crypto payments and taxes.

The Role of Technology in Simplifying Compliance

Technology will be the key to managing the increasing complexity of crypto payments and taxes. Expect to see more sophisticated accounting and tax software that leverages AI to automatically categorize transactions, calculate gains and losses in real-time, and even prepare draft tax forms. The automation of compliance will be essential for businesses to operate at scale in the digital asset economy.

Mastering Your Strategy for Crypto Payments and Taxes

Accepting cryptocurrency is a powerful way for businesses to innovate, reduce transaction costs, and connect with a new generation of consumers. However, this opportunity comes with the non-negotiable responsibility of meticulous tax compliance. The intricacies of crypto payments and taxes require a proactive, educated, and technology-driven approach.

By understanding that crypto is treated as property, diligently tracking the Fair Market Value of every transaction, implementing specialized software, and seeking expert professional advice, businesses can confidently navigate this complex landscape. The regulations surrounding crypto payments and taxes will undoubtedly continue to evolve, but a commitment to building a robust compliance framework from day one will ensure that your business reaps the rewards of the digital economy while protecting itself from risk.

Frequently Asked Questions (FAQ)

1. Is receiving a crypto payment for goods or services always a taxable event?

Yes. When your business receives cryptocurrency as payment, it is treated as ordinary income. You must record the Fair Market Value (FMV) of the crypto in your local currency at the exact time of the transaction and report it as revenue. This is a foundational rule for crypto payments and taxes.

2. How do I accurately determine the Fair Market Value (FMV) of a crypto payment?

The best practice is to use a consistent, reputable source, such as a major cryptocurrency exchange (like Coinbase or Kraken) or a crypto data aggregator. You should record the price at the specific date and time the transaction was confirmed. Many crypto tax software platforms automate this process for you.

3. Do I have to pay taxes if the value of the crypto I received goes down before I sell it?

You still have to report the income at the value it was when you received it. If you later sell or spend that crypto at a lower value, you will realize a capital loss. This loss can often be used to offset other capital gains, which is an important strategic consideration in managing crypto payments and taxes.

4. What is the single biggest mistake businesses make with crypto payments and taxes?

The most common and costly mistake is poor record-keeping. Failing to track the cost basis and Fair Market Value of every single transaction makes it impossible to accurately calculate income and capital gains. This often leads to significant problems during tax filing or an audit.

5. For tax purposes, is it better to hold crypto received or convert it to fiat currency immediately?

Converting to fiat immediately simplifies tax calculations. When you convert instantly, the income you record is very close to the proceeds from the “sale,” resulting in a minimal capital gain or loss. Holding the crypto introduces volatility and requires you to track a separate capital gain or loss when you eventually dispose of it, adding complexity to the management of crypto payments and taxes. The decision depends on your business’s risk tolerance and accounting capabilities